Credit Card Impact Your Credit Score

Keeping Your Credit Cards for a Long Time

Credit card impact your credit score greatly. The longer you’ve had your credit cards open, the better it is for your credit score, especially if you have a positive payment history with those credit cards. Keep your oldest credit cards around and use them periodically to help out your credit score, but also make sure you check out the latest credit card deals from time to time. If you have a good credit score, there’s a chance you can qualify for a credit card with better terms and rewards than the one you’ve had since you were a young adult.

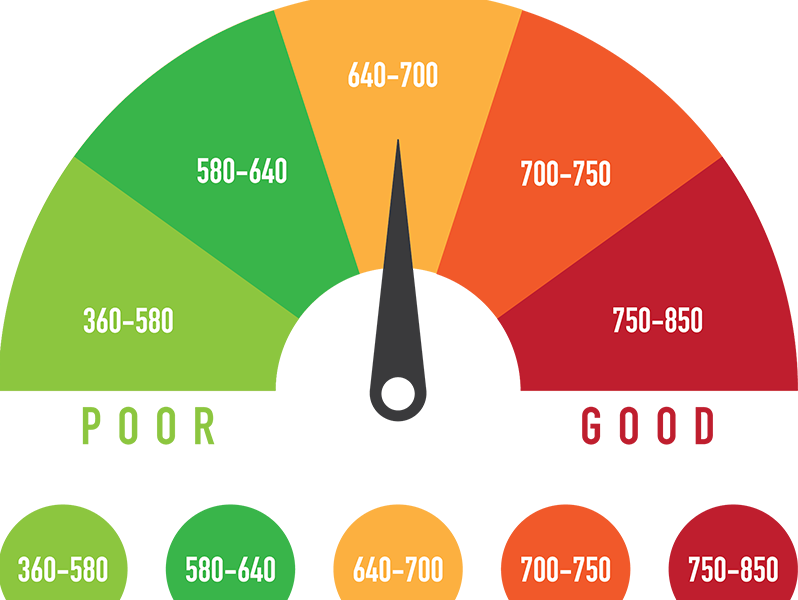

Your credit score is based on the information on your credit report– a record of your credit and loan accounts maintained by companies called credit bureaus– that indicates the likelihood that you’ll pay back money loaned to you. Each month, your credit card issuer (among a few other businesses) reports your credit card activity to one or more of the three major credit bureaus to be included in your credit score. Your credit limit, credit card balance, payment history, account status, and date you opened the account are a few pieces of information that affect your credit score.

Your Credit Limit and Balance Information

Many credit cards have a present credit limit, which is the maximum amount of credit your credit card issuer has made available to you. Even though they’ve given you a certain credit limit, it looks bad if you use up all the credit. Because of it, maxing out your credit card– using all your available credit– makes you look like a risky borrower and your credit score will suffer.

Many credit card issuers also report a “high balance” which is the highest balance ever charged on your credit card. Even if you max out your credit card and pay it off, your credit report can still show that high balance. It’s best to keep your credit card balance below 30 percent of your credit limit so you don’t look like an irresponsible borrower.

Everything you do with a credit card affects your credit score from applying to a credit card to using one. Your credit score is based on the information on your credit report– a record of your credit and loan accounts maintained by companies called credit bureaus– that indicates the likelihood that you’ll pay back money loaned to you. Each month, your credit card issuer (among a few other businesses) reports your credit card activity to one or more of the three major credit bureaus to be included in your credit score. Many credit cards have a present credit limit, which is the maximum amount of credit your credit card issuer has made available to you. The companies who developed the credit score haven’t told us the exact number of credit cards that influence your credit score.

Having solid experience with different types of credit accounts– credit cards as well as loans– is good for your credit score.

On time credit card payments help boost your credit score while late payments will bring your credit score down. Late payments aren’t typically reported to the credit bureaus until they’re 30 days late. You might have to pay a late fee if you’re a few days late on your credit card payment, but your credit score should be safe as long as you pay before you’re 30 days past due.

Credit Card Applications

Every time you apply for a credit card, a record of your application goes onto your credit report. Your credit score doesn’t factor in whether you’re approved for the credit card or not.

Credit cards can hurt or help your credit score; it depends on how you use them.

Your Monthly Credit Card Payments

Your last credit card payment amount is included on your credit report, it’s not factored into your credit score. Remember that your balance relative to your credit limit is included in your credit score.

The Number of Credit Cards You Have

The companies who developed the credit score haven’t told us the exact number of credit cards that influence your credit score. In January 2015, Time reported a man with 1,497 credit cards and a near perfect credit score.

Everything you do with a credit card affects your credit score from applying to a credit card to using one. Even not having a credit card can affect your credit score.

Just Having a Credit Card Affects Your Credit Score

Your credit score could be affected if you’re one of many consumers who doesn’t have a credit card. If you have a credit score at all, that’s. Without open, active accounts on your credit report, you won’t have a credit score.

Credit cards are one of the easiest types of credit accounts to get which makes them a good option for establishing and building a good credit history. Your credit score will reflect that if you manage your credit well.

The key to making sure your credit cards don’t hurt your credit score is to keep them active and open, in good standing, and with low balances.